CHALLENGE

As the app adoption soared, PeiGo faced a new challenge: how to find a distinctive service that generates recurring revenue?

SOLUTION

In Latin America, peer-to-peer lending is common — but risky.

We created a feature that protects young earners when friends don’t pay back.

Behavioral Insights

Audience Strategy

Ideation Workshops

Product Design

SERVICES

context

In LatAm, 70% earn daily in cash-driven communities.

We explored how technology could strengthen a familiar ritual—protecting lenders while keeping friendships intact.

when ideas become products

We built a solution for community-based finance, protecting lenders from bad payers.

OUR PROCESS

Ideation workshops

We led divergent design workshops combining empathy mapping, scenario exploration, and rapid ideation. Neurodivergent perspectives revealed lived lending behaviors within tight-knit communities, while client teams added operational constraints.

Together, we uncovered patterns, mapped user pain points, and shaped the opportunity that inspired the feature concept.

The Insight

When communities rely on each other. Borrowing sugar, rice — even $10 in cash — from friends and neighbors, is part of daily life. But when a friend doesn’t repay, the real loss isn’t the money; it’s the relationship.

This sparked a question: How might we make lending safer, simpler, and fairer?

The Anti-Deadbeat Insurance was born — a peer-to-peer lending feature that reduces default risk and introduces a financial reputation system—like a FICO score—enabling Peigo identify good payers and expand credit access over time.

THE RESULT

The Idea in Action

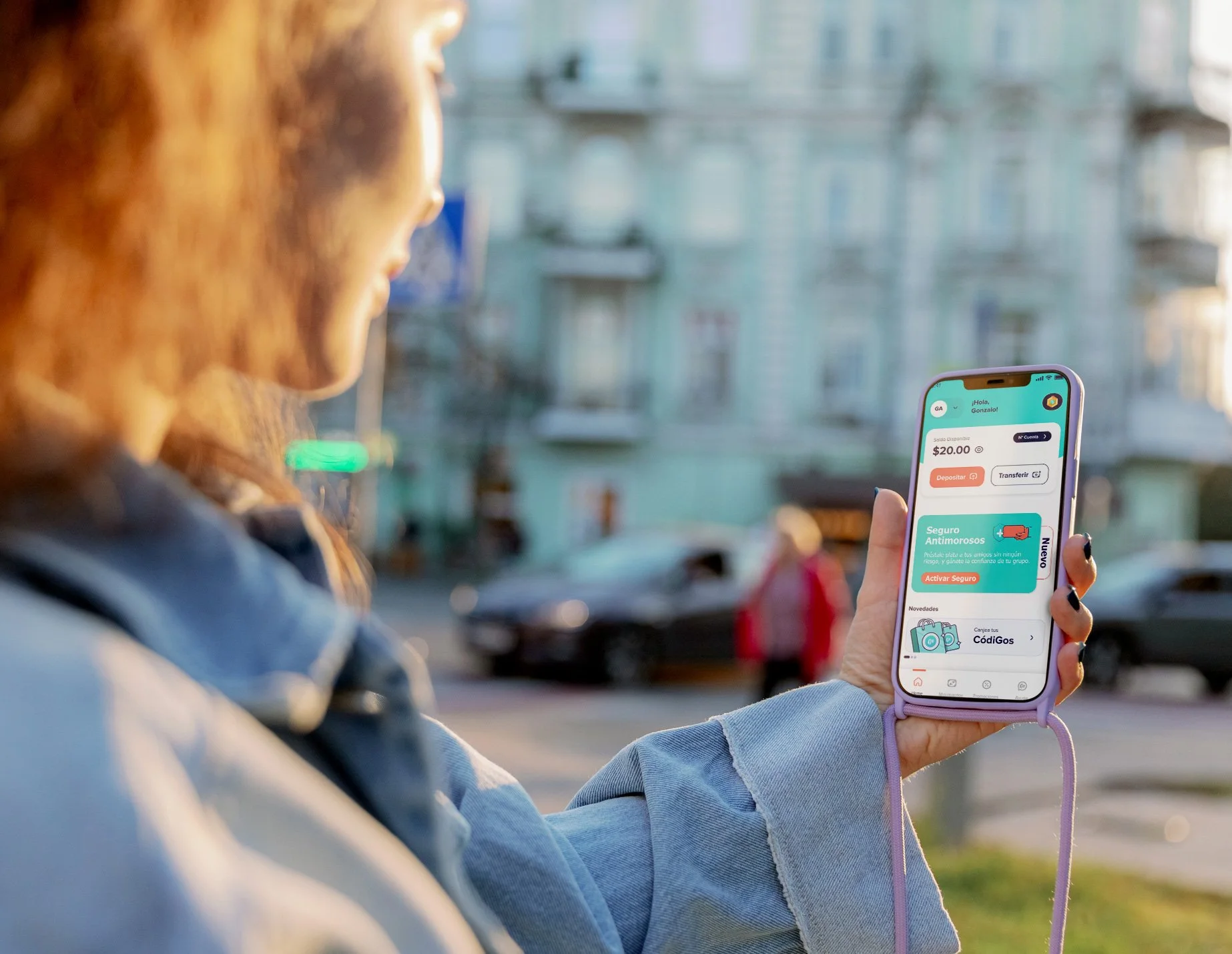

Peigo launched Latin America’s first peer-lending insurance.

It unlocked new revenue streams and reimagined peer lending turning risky borrowing into a safer, smarter exchange.

Several hundred thousand dollars were invested by Peigo to develop the Anti-Deadbeat Insurance feature.